Idea Brunch with Altay Capital

Welcome to Sunday’s Idea Brunch, your interview series with great off-the-beaten-path investors. We are very excited to interview Altay Capital!

Altay Capital is a professional investor who shares ideas with 7,000+ followers under the pseudonym @AltayCapital on Twitter. Altay Capital is a private long/short investor unaffiliated with any fund and has extensive experience in the video game industry, where he founded a company that was later acquired. Altay Capital also shares overlooked and off-the-run Japanese equity ideas in his newsletter.

If you like today’s interview please consider hitting the heart button, forwarding us to a friend, or replying with a future guest you’d like interviewed. Our ability to get great guests like Altay grows with your continued support!

Altay, thanks for doing Sunday’s Idea Brunch! Can you please tell readers a little more about your background and your investment process?

I began investing when I was 16 when my father set up a joint custody brokerage account for me with a few thousand dollars in it. I learned a ton but blew up the account during the 2008 financial crisis. I dropped out of college in my second year after one of my web businesses took off and I eventually sold that in 2010. I’ve been investing full-time since.

I consider myself a value investor, but given my inherent value biases, I missed out on the massive outperformance of big tech U.S. stocks. Still, my performance has been good, so I can’t complain. From 2014 up to Feb 28, 2023 (when I changed brokers) my account was up 315% vs 183% for S&P 500 TR.

I like to focus on areas where few people are looking. The usual wisdom in this space is to focus on small caps as it's an area of the market where small guys can have an edge. Most small-cap stocks in the U.S. tend to be pretty crappy though, so I spent a lot of time on really obscure U.S. OTCBB stocks, the kind of stuff Nate Tobik writes about on Oddball Stocks (I was a subscriber!). Unfortunately, after some new SEC rules were implemented, most of these names moved to the expert market and trading them became too hard.

I also like owning stocks in hated industries. I did really well buying an MLP closed-end fund in 2020 when it was trading at a 25%+ discount to net asset value and did well on coal names like AMR & ARCH. Excluding dividends I'm up ~250% on the MLP fund which I still own.

For the last ~15 months though I've been really interested in Japanese stocks. ~65% of my portfolio is in Japan right now.

You’ve written a lot about the potential in Japanese equities and the governance changes going on in that market. Why are you investing so heavily in Japan?

Stocks in Japan are cheap because companies have historically been extremely conservative. They pile up cash and don’t do anything with it, but that’s beginning to change. You have incredibly cheap valuations coupled with a push by the Tokyo Stock Exchange (TSE) and the Japanese government to improve corporate governance. The exchange is asking listed companies to improve return on equity and get their stocks above 1x P/B. Even the Japanese government has been encouraging companies to improve corporate value. There is a coordinated ‘push’ from the top down to get Japanese companies to improve governance and eliminate the big P/B discounts. The biggest P/B discounts are in the sub $100m market cap part of the market that few people are even looking at.

The TSE currently publishes a list every month of companies that have complied with their request to disclose a plan that demonstrates that management is conscious of their cost of capital and what they intend to do to improve RoE and close the P/B discount. The TSE only began publishing this list in late January 2024 and will continue to update it monthly. While most companies have not complied yet, I suspect most will due to social pressure.

Small-cap Japanese stocks are stupid cheap. Here’s an example: Marufuji Sheet Piling (Ticker 8046) has a market cap of $69m but has current assets of $236m and total liabilities of $98m. This puts net current asset value (NCAV) at $138m. Their net current assets are worth 2x the market price. Something must be wrong here, right? It must be a melting ice cube or something, but no. They’ve been profitable for over 10 years straight. Since 2001 they have only reported losses in 2 years. Other metrics today: 0.3x p/tbv, P/E of 7.4x.

When a stock trades at half of its net current asset value I call it a double net-net, meaning that it could double in price and it would still value the business at $0. Japan has several decent double net-net names and a lot of dirt-cheap regular net-nets that have 10-15+ years of consistent profitability. Most net-nets I see in the U.S. are melting ice cubes with consistent losses. Most net-nets I find in Japan have been profitable for 10-15+ years straight.

Even outside of net-nets, there are a lot of interesting opportunities in small-cap logistics companies in Japan. I wrote up Asagami Corporation (Ticker 9311) on my Substack which trades at 0.4x p/tbv and owns warehouses in Japan. Their market cap is ~$52m and just 3 of their properties on Tokyo Harbor have a land value of ~$52m on the balance sheet, but these assets are likely worth $190m+ based on appraisals for nearby properties! The company owns many other warehouses too which are likely undervalued.

My strategy in Japan is to build a large basket of extremely cheap stocks. Everything I own in the basket trades below 1x price to tangible book but holdings vary from dirt cheap net nets at 0.3x p/tbv to higher quality growing names that trade at 0.7x p/tbv. The one overarching theme is that they’re all incredibly cheap.

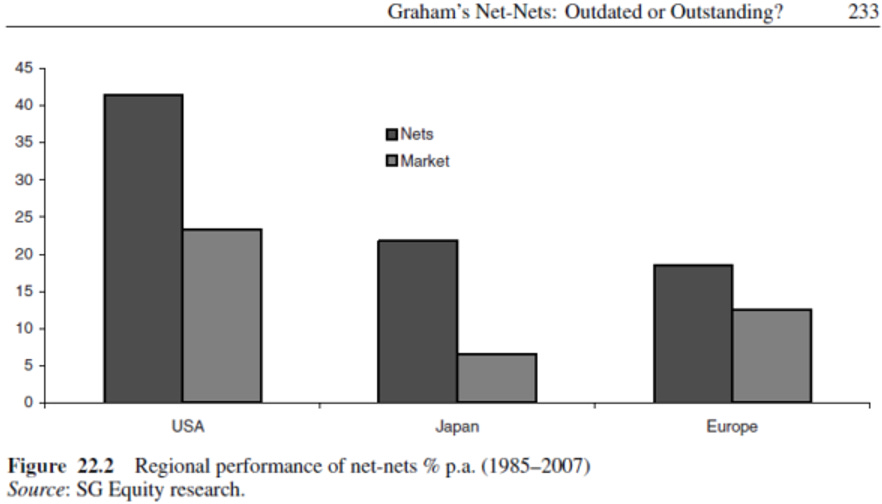

A lot of people seem to think this strategy won’t work and that Japan has always been cheap, but if you look at historical returns, Japanese net-nets as an asset class have outperformed their benchmarks massively.

Besides historical outperformance, the Tokyo Stock Exchange's push to improve governance should also boost returns. One of my dirt cheap Japanese stocks Onamba Co (Ticker 5816) announced that they will comply with the stock exchange’s request and published a plan saying they’ll increase their dividend, boost investments with the goal of increasing return on equity, and consider doing buybacks. The stock went up 40% in 2 days. The attitude towards stock buybacks and shareholders is changing in Japan and I expect many more companies will disclose plans to improve shareholder returns.

I also recently used ChatGPT to write up a generic email in Japanese asking companies about the Tokyo Stock Exchange’s request and why they aren’t on the “good list” of companies that have complied. The letter was extremely polite and supportive, but I did ask what customers and business partners would think if their company name wasn’t on that list. Surprisingly many companies wrote back saying they are planning on releasing a plan to get on that list and one company even specifically told me when they will release a plan. They also said they’ll aim to get their stock trading above 1x book value quickly! I bought more shares in that company.

So many people on FinTwit and elsewhere say stuff like “Warren Buffet had it easy. Back then you could find net-nets and extremely cheap good companies in the U.S. at dirt cheap valuations! Those opportunities don’t exist anymore.” While that’s mostly true in the U.S. market, it’s absolutely not true if you look at Japan.

What’s surprising to me though is that despite this opportunity, very few people are looking at these kinds of Japanese stocks. My posts on X about some of these smaller companies are almost always the only posts discussing these names. Even on Yahoo! Finance Japan, the message boards for most of the companies I’m interested in are totally dead. These are completely overlooked names.

I think in 5-10 years everyone is going to look back at this period and say “duh, of course you had excellent returns, you were buying net-nets with 10+ years of profitability at 7 P/E!”

As you know, there are a lot of very cheap stocks in Japan. Beyond screening for low price-to-book and price-to-earnings, what else do you look for before investing in a Japanese stock? And what mistakes do you see novice investors make when investing in Japanese equities?

I’m looking for 3 things in my cheap Japanese basket: 1) big discount to p/b. Ideally net-net valuation. 2) consistently profitable (5-10+ years). 3) 1.5%+ dividend. I figure with this combination, it’s going to be pretty hard to lose money. The dividend payment is nice as it’ll cover my cost to borrow yen, which for me at Interactive Brokers is 0.75%.

I try to avoid melting ice cubes. Businesses that are slowly dying with profits and topline shrinking. There are so many companies in Japan with good metrics, that I’m not interested in companies with materially declining financials, even if they’re cheap.

I don’t think many novice investors or even pros are looking at small-cap Japan, but a few easy mistakes anyone can make is too much concentration. I’m extremely diversified in Japan and am making a thematic bet on a basket of extremely cheap stocks. Some of my lowest conviction names have outperformed my highest conviction names, so I’ve increased diversification. My largest position is only about 2% of my portfolio. Most of my Japanese names are 1% or less.

I’ve also seen people buying U.S.-listed Japan ETFs to try and get exposure to this theme, but none of the ETFs are a good way to play it as the average P/B ratios of them are already above 1x. The small-cap Japan ETF has an average P/B of 1.25x.